|

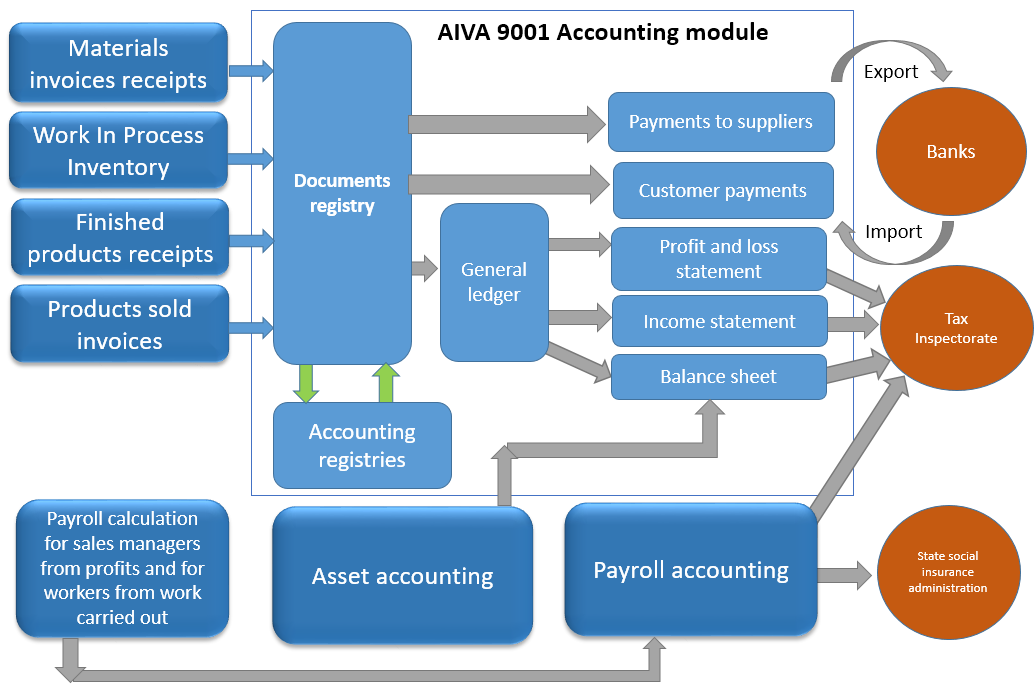

Currently, in AIVA 9001 the vast majority of accounting functions are automated with exception of temporary payroll accounting and settlement with SODRA (State social insurance administration).

AIVA Accounting Description 1. Directories for accounting This program implements the procedures of introduction of an account plan and attribution of the accounts to the item groups and etc. 2. Attribution of operational correspondences accounting during sale and purchase of goods When recording (debiting) the materials or products to the proceeds of the warehouses, when issuing the VAT invoices for the goods or products sold, or during the internal goods transfer displacement, the program itself assigns the accounting account/statement by settling a necessary correspondence of accounts. 3. Control and planning of payments from clients In order to implement the control of payments from clients, the credit conditions shall be entered in the client’s data, and the payments – in the client’s orders. The program controls the payment from clients: 1) during issuance of new VAT invoices, the program warns if amount or time of credit is exceeded 2) payments can be supervised by managers when exercising the control over their clients' orders, where the program indicates the paid/unpaid orders, the outstanding balance, delivered/undelivered goods and etc. 3) using the special functions of the program In the latter case, the debtors’ selection criteria can be entered. The program selects the debtors on these criteria. Then an accountant or manager can prepare an alert message and give the command to send this message. The program generates electronic mail messages with the message text prepared for every debtor informing about the outstanding debt. The program shows the report with future payments from the clients in various forms, including graphs according to the coming months. This report uses the planned dates of delivery of the customer orders. 4. Control of payments to suppliers Whereas the orders to suppliers are sent directly through the program, it contains the data on each order made to suppliers. While viewing a list of the orders sent, an accountant sees the orders that have already been fulfilled, i.e. the goods received, and the accountant can enter the payment. Using these data, the program automatically generates a report on the paid/unpaid orders, thereby assisting the accountant to control the payments to suppliers. 5. Cash desk/register accounting The program includes a cash accounting for the goods sold. There are reports on cash receipt, cash deposits to a bank account or cash transfers to cash tills, cash balances in the cash register. The program is used for a proper cash accounting in stores. 6. Accounting of expenses The program includes the function of registration of all operating costs - power, gas, telephone and etc. costs according to the VAT invoices received for use of these services. 7. Accounting statements The program generates the standard bookkeeping statements: General Ledger, General Journal, Profit and Loss Statement, and Balance Sheet. The account balances are entered in a special form, in which other figures, not calculated in this program, are also entered as salaries, assets, etc. |

|

|||||||||||||

|

Slapukų naudojimo taisyklės © 1995 - 2025 Aiva sistema. Svetainėje pateiktą informaciją naudoti be sutikimo draudžiama.

|

|||||||||||||

Sales automation

Sales automation Financial Accounting

Financial Accounting